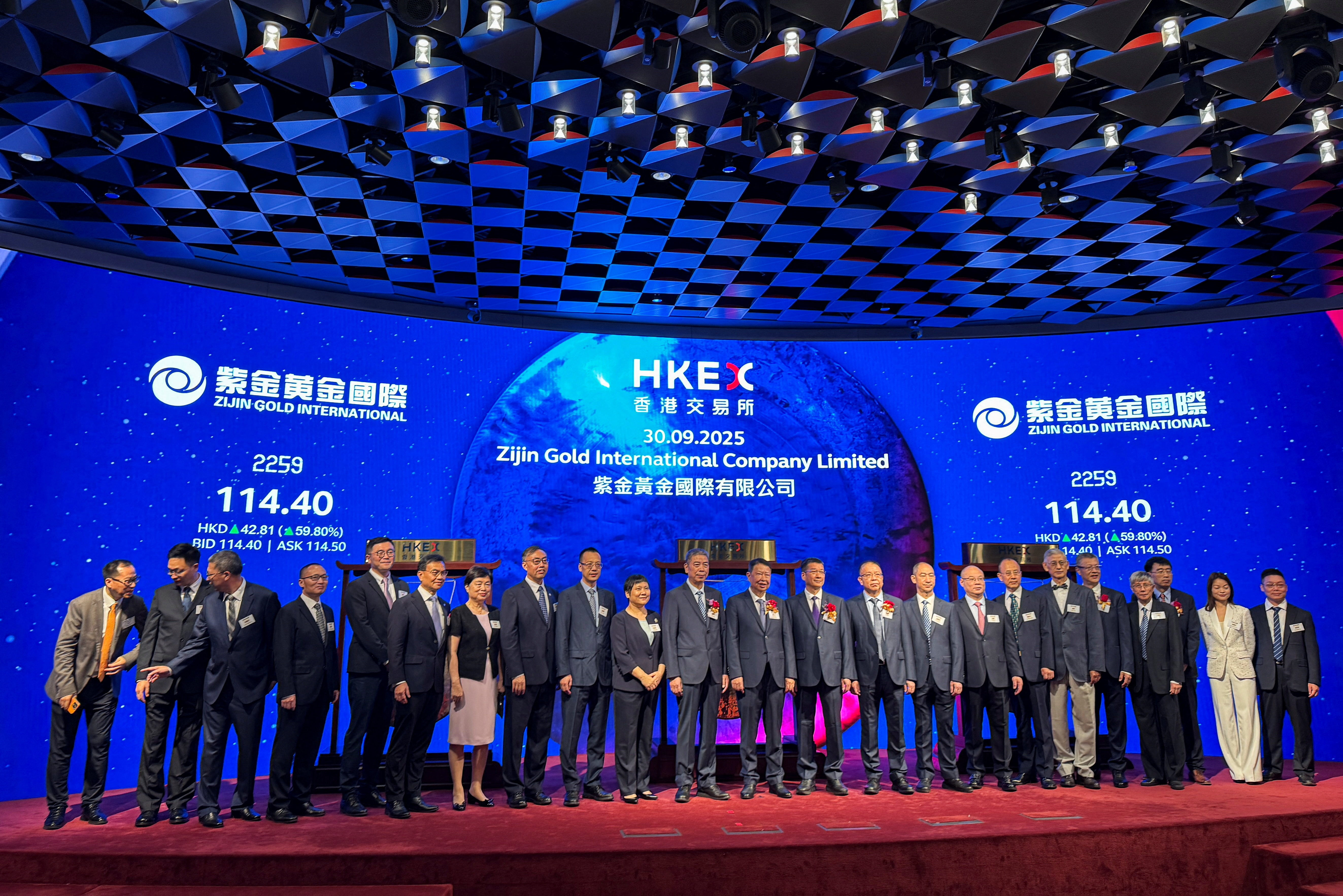

HONG KONG: Shares in China’s Zijin Gold International surged more than 60 percent on its debut in Hong Kong on Tuesday after raising more than $3 billion in one of the world’s biggest initial public offerings this year.

The strong opening comes as gold prices continue to hit record highs amid demand for the safe-haven asset, driven by broader market volatility and expectations of U.S. interest rate cuts.

The prospect of a U.S. government shutdown has also added momentum for the precious metal, which climbed to a peak of $3,867.89 on Tuesday.

Analysts said it could soon hit $4,000, having gained almost 50 percent since the start of the year.

Zijin Gold, a unit of Zijin Mining, China’s largest miner, rose as much as 67 percent to HK$120, valuing it at about HK$300 billion ($38.6 billion).

The company is among the world’s fastest-growing gold producers, with stakes in eight mines across Central Asia, South America, Oceania and Africa.

It said it has extensive experience in global mergers and acquisitions involving mine assets.

“We have strong cost management capability, with several of our mines turning profitable shortly after our acquisitions,” the firm said.

Proceeds from the IPO will be used to settle the acquisition of a gold mine in Kazakhstan and to upgrade and construct existing mines over the next five years, according to its prospectus.

Global demand for gold is expected to grow on increased interest from central banks seeking value preservation and risk diversification, consultancy Frost & Sullivan said.

It added that prices would also be supported by declining mine quality and rising extraction costs.

Hong Kong’s Financial Secretary Paul Chan said Sunday that initial public offerings had raised nearly HK$150 billion so far this year, ranking first globally.

Accountancy firm Deloitte said last week that it forecasts Hong Kong will see more than 80 IPOs in 2025, raising up to HK$280 billion.