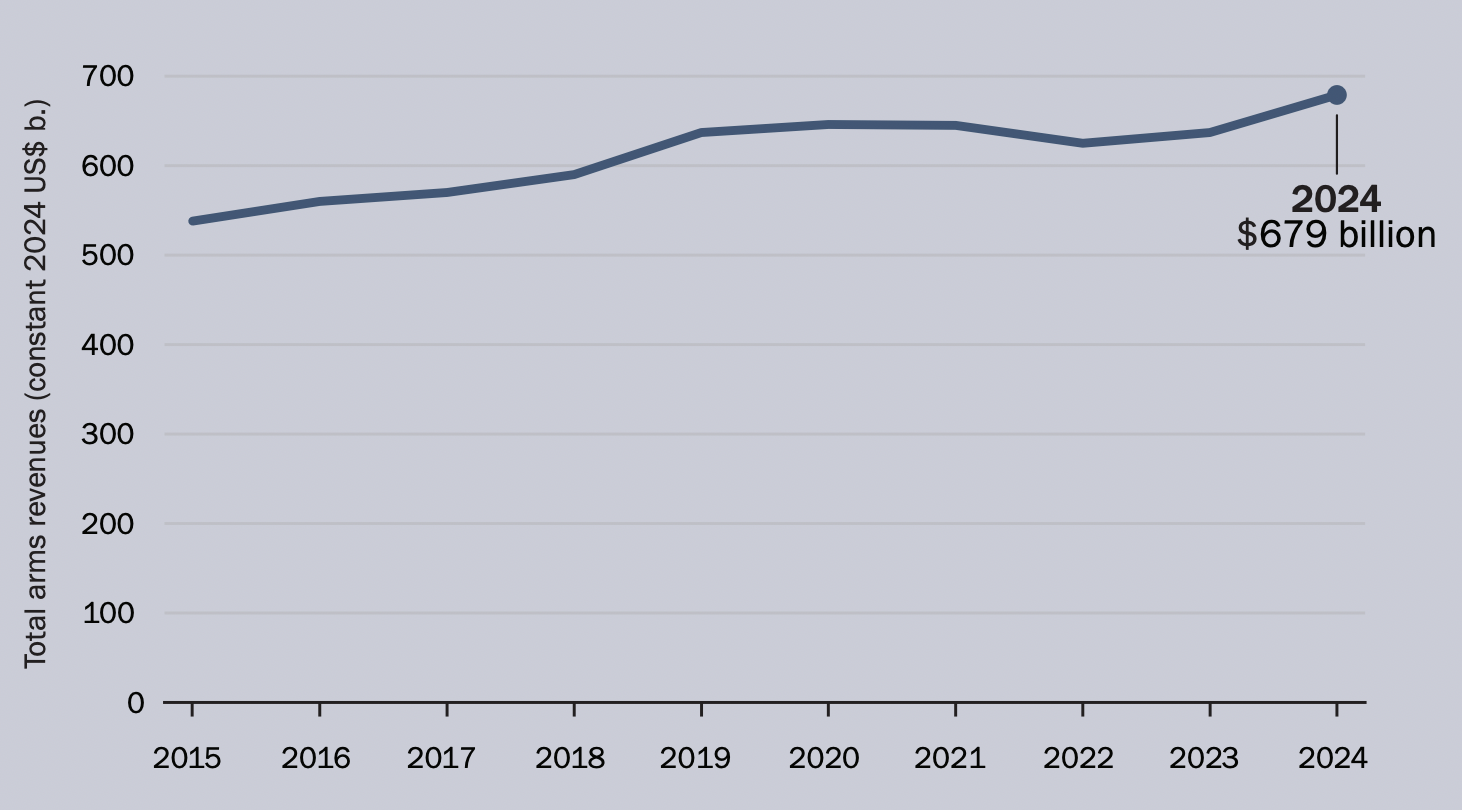

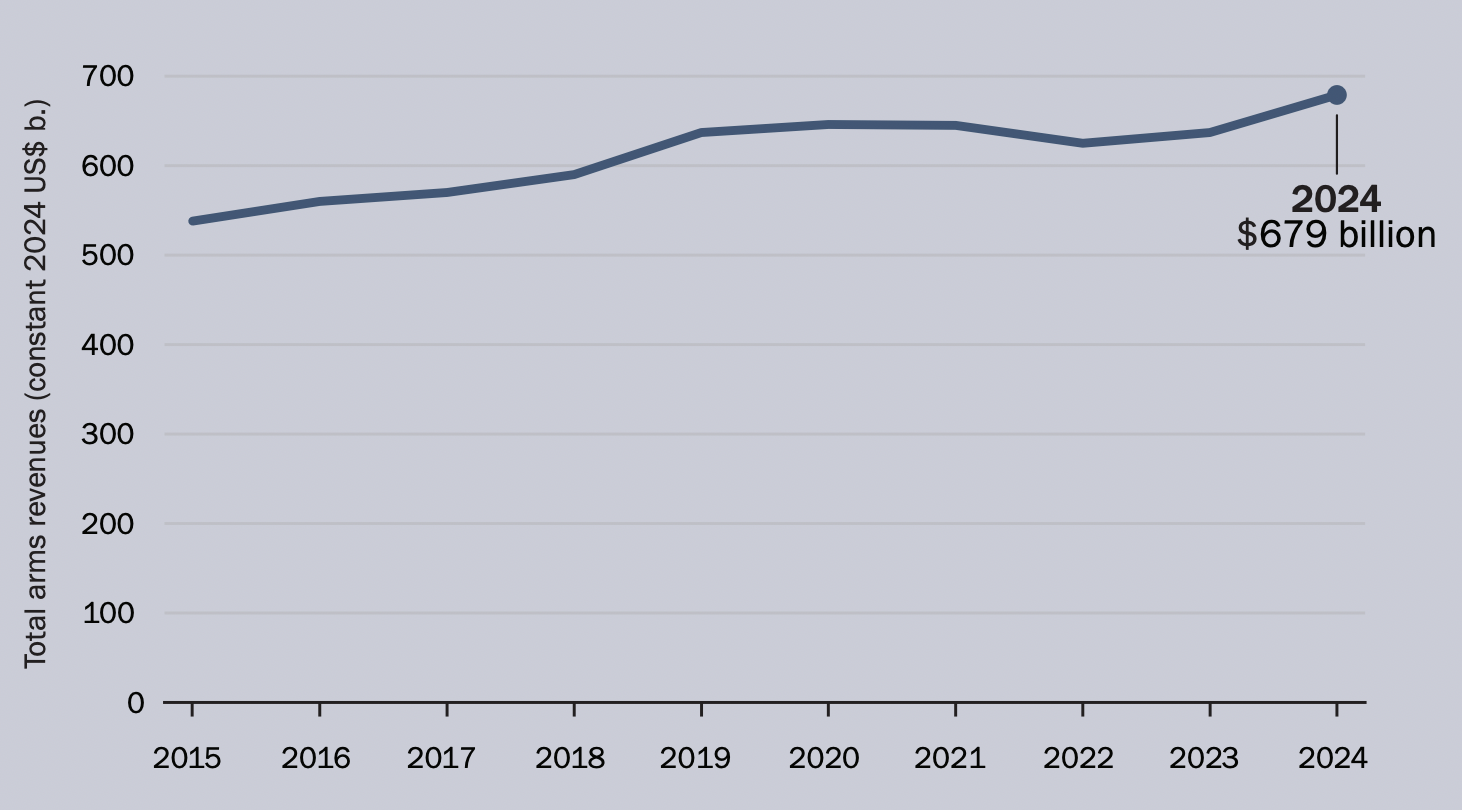

ISLAMABAD: Global arms sales by the world’s top 100 arms manufacturers reached a record US$679 billion in 2024, up 5.9% from the previous year, the Stockholm International Peace Research Institute (SIPRI) reported on Monday in its latest publication.

The figure marks the highest total SIPRI has ever recorded. The surge comes as the wars in Ukraine and Gaza, alongside rising geopolitical tensions, drove governments worldwide to modernize and expand their arsenals. Over the past decade, total defense revenues of the Top 100 companies have increased by 26%.

Total arms revenues of companies in the SIPRI Top 100, 2015–24 (SIPRI factsheet)

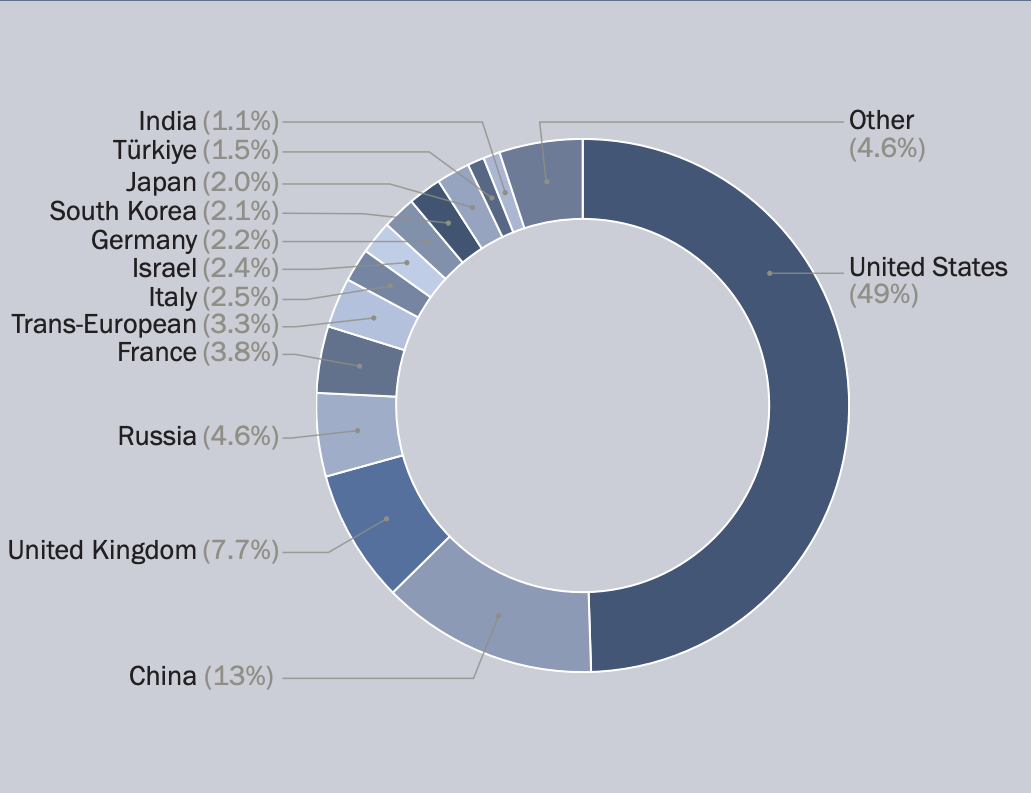

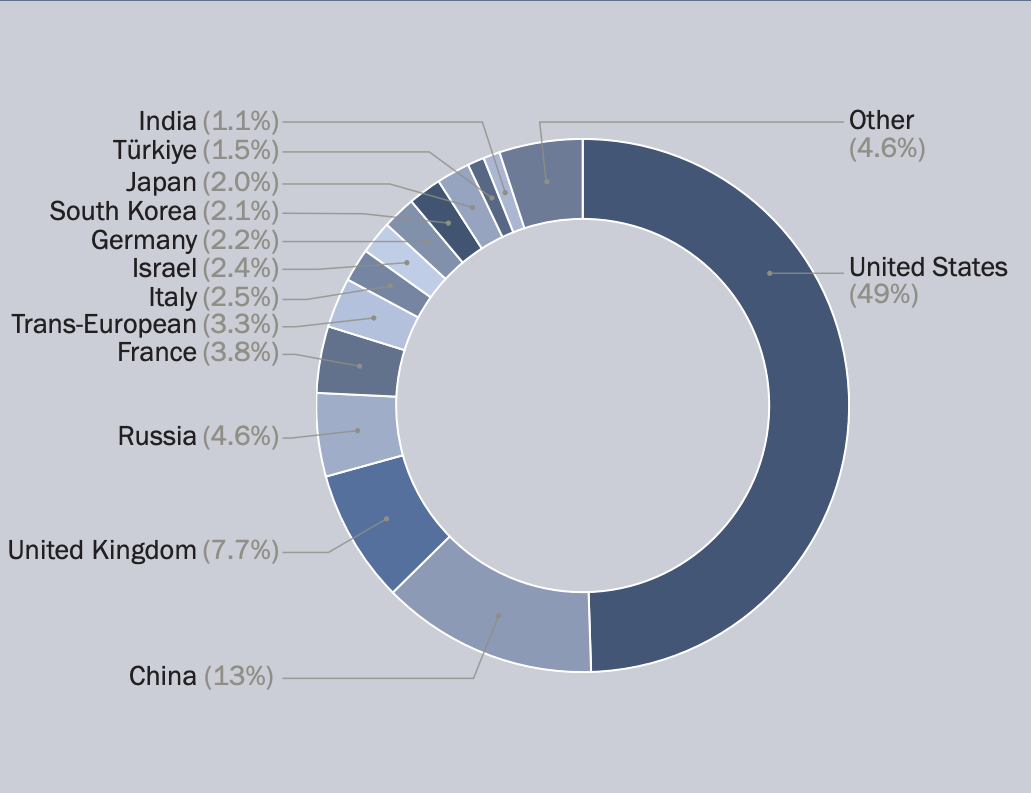

The majority of growth in 2024 came from the United States and Europe. US-based companies, including Lockheed Martin, Northrop Grumman, and General Dynamics, saw combined revenues rise 3.8% to $334 billion, with 30 of the 39 firms reporting gains. For the first time, Elon Musk’s SpaceX appeared on SIPRI’s Top 100 list, with arms-related revenues more than doubling to around $1.8 billion compared with 2023.

“Last year, global arms revenues reached the highest level ever recorded by SIPRI as producers capitalized on high demand,” said Lorenzo Scarazzato, researcher with SIPRI’s Military Expenditure and Arms Production Programme.

Regional breakdown

Share of the total arms revenues of companies in the SIPRI Top 100 for 2024, by country (SIPRI factsheet)

The sharpest gains came from the United States, Europe, and Russia, while China and the wider Asia–Oceania region saw a decline.

Aggregate revenues for European (non-Russian) arms manufacturers rose 13% to $151 billion. The Czech firm Czechoslovak Group recorded the largest percentage gain among all Top 100 producers, with revenues jumping 193% to nearly $3.6 billion, largely due to contracts supplying artillery shells to Ukraine, according to SIPRI.

Russia is growing despite sanctions

Despite ongoing Western sanctions and component shortages, Russia's two Top 100 companies, Rostec and United Shipbuilding Corporation, raised their combined revenues by 23% to $31.2 billion. SIPRI says domestic demand alone was sufficient to offset the decline in exports.

Asia & Oceania saw a drop, India's revenues on the rise

This was the only region to see an overall decline, with revenues dropping 1.2% to $130 billion, mainly due to a 10% fall among eight Chinese defense companies.

“A host of corruption allegations in Chinese arms procurement led to major contracts being postponed or cancelled in 2024,” said Nan Tian, director of SIPRI’s Military Expenditure and Arms Production Programme.

In contrast, Japanese companies grew 40% overall, and South Korean producers increased 31%, benefiting from strong domestic and international demand.

India’s three Top 100 companies recorded an 8.2% rise in combined revenues to $7.5 billion, driven by domestic orders.

Israel profited from the Gaza genocide exponentially

Nine companies from the region entered the Top 100 for the first time, with combined revenues of $31 billion, a 14% increase over the previous year. Three Israeli firms alone saw revenues climb 16% to $16.2 billion, fueled by demand for drones, air defense, and counter-drone systems during the Gaza conflict.

“The growing backlash over Israel’s actions in Gaza seems to have had little impact on interest in Israeli weapons,” said Zubaida Karim, SIPRI researcher.

According to SIPRI, the United Arab Emirates' state-owned corporation, EDGE Group, recorded $4.7 billion in revenue.

The surge comes with challenges

SIPRI attributed the surge in revenues largely to increased demand for weapons and military services as countries responded to wars, geopolitical conflicts, and a global rearmament effort.

Many firms expanded production lines, built new facilities, established subsidiaries, or acquired companies to meet rising demand.

However, the report noted growing challenges for the industry. Supply-chain constraints, reliance on essential raw materials, and persistent delays and cost overruns in major projects remain a concern. In the United States, long-term programs such as the F-35 combat jet, Columbia-class submarines, and Sentinel ICBMs continue to experience setbacks, casting uncertainty on delivery schedules and future defense planning.

As governments rush to modernize their arsenals and respond to perceived threats, the global arms industry is entering a period of rapid expansion, with the potential to shape international security budgets for years ahead.

.jpg)

.jpg)