Gold and silver bars are stacked in the safe deposit boxes room of the Pro Aurum gold house in Munich, Germany, October 13, 2025. (REUTERS/File)

Latest News

South Africa thrash West Indies in T20 World Cup statement win

3 HOURS AGO

Nearly 8,000 died or vanished on migrant routes in 2025: UN

4 HOURS AGO

Russian says 'no deadlines' to end Ukraine war

5 HOURS AGO

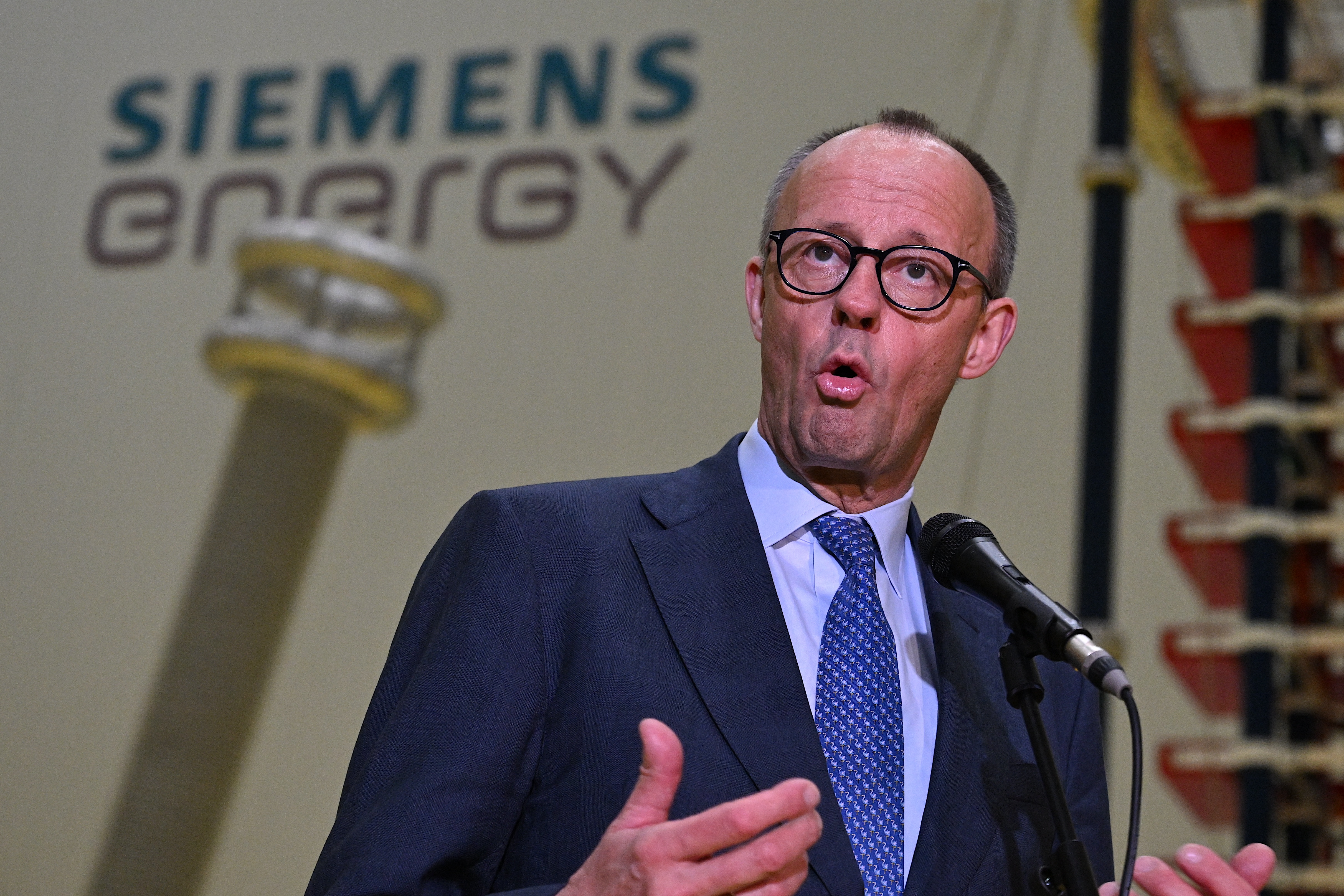

Merz says Germany, China must overcome trade gaps 'together'

7 HOURS AGO

Pakistani, European ministers agree on coordinated strategy to combat illegal migration

7 HOURS AGO