.jpg)

Pakistan Stock Exchange. (APP)

LAHORE: In a groundbreaking move for Pakistan’s capital markets, the Pakistan Stock Exchange (PSX), in partnership with the National Clearing Company of Pakistan Limited and the Central Depository Company of Pakistan Limited (CDC), has introduced new guidelines that allow minors under the age of 18 to open trading accounts.

The initiative, developed under the oversight of the Securities and Exchange Commission of Pakistan (SECP), is designed to empower Pakistan's youth with the tools to build financial literacy and increase participation in the country’s capital markets.

The move has been welcomed as a step toward "facilitating financial inclusion for the next generation," the SECP stated on its official Twitter handle.

The step is part of a broader effort to instill a culture of saving, investing, and financial discipline at an early age. Minors, with the help of their natural or court-appointed guardians, will now be able to access Pakistan’s capital markets, marking a significant shift in how young people engage with their financial futures.

Opening trading account made easy

As per the PSX notice, minors can open trading accounts under the supervision of a guardian. The guardian, whether a parent or a legally appointed representative, will manage the account, make investment decisions, and ensure compliance with regulatory guidelines.

This model protects young investors from potential risks in the unregulated world of stock trading, offering them a structured, safe, and educational experience.

The notice states that opening a minor's trading account is simple. Guardians are required to submit necessary documentation, including the minor's National Database and Registration Authority (NADRA) juvenile card or a child registration certificate. If the guardian is not a parent, a court-appointed guardianship certificate will be needed.

Once the account is established, the guardian assumes full control over all transactions, while the minor gains exposure to the stock market under careful oversight.

To protect young investors, certain limitations have been put in place. Minors will not be allowed to engage in high-risk activities such as trading in futures contracts or leveraged products. This helps ensure that young investors are shielded from volatile market instruments while they learn the basics of investing.

Account transition as minors turn 18

A key feature of this initiative is the seamless transition from a minor's trading account to a regular account upon turning 18. Upon reaching adulthood, the minor will gain full control over their account and be able to make independent investment decisions. The transfer process will include the transfer of assets, with clear guidelines to manage any tax implications and avoid unintended capital gains tax issues.

This feature ensures continuity in the investment journey, enabling young investors to carry on with their portfolios once they come of age without disruption to their financial planning.

Young people and money management

Industry experts believe that the introduction of minor trading accounts will have a long-lasting impact on Pakistan’s investment culture.

Experts believe that introducing minor trading accounts could have a lasting impact on Pakistan's investment culture.

Senior stockbroker and former chairman of Pakistan Stock Brokers Association Dr Yasir Mahmood, talking to Pakistan TV Digital, said, “With financial literacy still relatively low in the country, this initiative provides an opportunity to teach young people about the importance of saving, investing, and managing money.”

By engaging minors in the capital markets, the “PSX is not only preparing them for their financial futures but also contributing to the development of a more financially responsible society,” he added.

Securing financial futures

The PSX’s decision to allow minors to open trading accounts is expected to broaden participation in Pakistan’s capital markets, especially among younger generations.

CDC officials talking to Pakistan TV Digital also expressed their support for the initiative, noting that it offers an exciting opportunity for parents and guardians to involve children in their financial decisions. By teaching children the value of money and investing at an early age, families can give their children a head start in securing their financial futures.

The regulated nature of the investment process ensures that the youth can begin their journey toward financial independence in a safe environment, ultimately contributing to a more investment-savvy generation.

Latest News

South Africa thrash West Indies in T20 World Cup statement win

3 HOURS AGO

Nearly 8,000 died or vanished on migrant routes in 2025: UN

3 HOURS AGO

Russian says 'no deadlines' to end Ukraine war

4 HOURS AGO

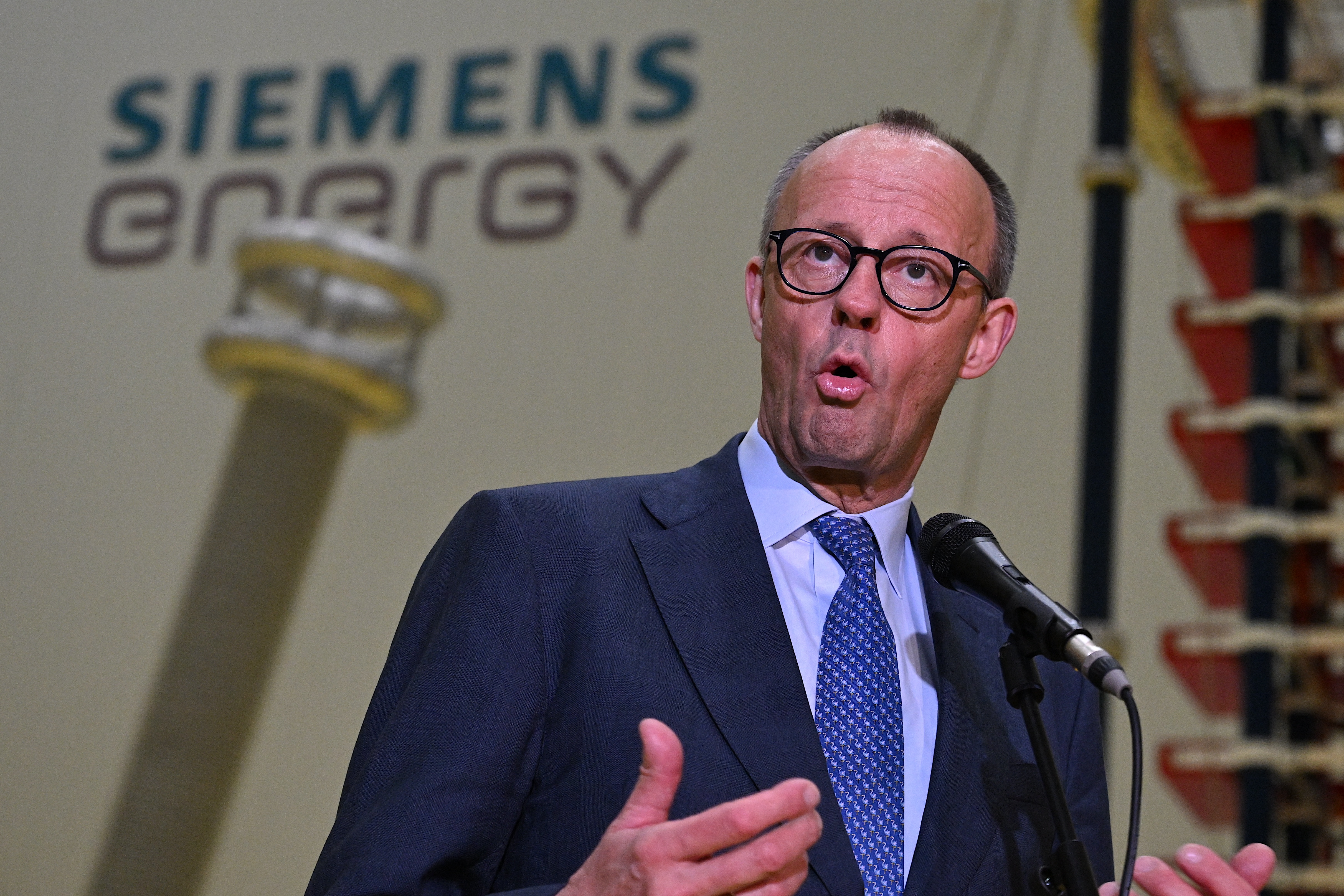

Merz says Germany, China must overcome trade gaps 'together'

6 HOURS AGO

Pakistani, European ministers agree on coordinated strategy to combat illegal migration

7 HOURS AGO